Why Partner with Lender’s Cooperative?

Our services combine lending software with a growing cooperative of banks that are working together to think differently about how they efficiently manage back-office operations.

Secure, Cloud Based Online Portal – Operated by Bankers

End - End Automation – Custom Digital Application & Documentation Intake through Core Integration

Platform Product & Workflow Expansion – Small Business C&I Portfolio, SBA 7A & then to Commercial Lending Products

Staffing Partnership – Our Credit Team can handle Credit Underwriting & Credit Servicing to help lower Efficiency Ratios while growing Volume

LOS Product Expansion

-

Small Business C&I Portfolio Product

-

Commercial Lending Products

-

SBA 7A Product & Workflow

-

PPP Cost

Credit Rules Engine defined by each Lender to allow Automated Straight Through Processing

Platform Integrations - FICO SBSS, Plaid, KYC, UCC Filings, Closing Docs, Docusign

Decrease Application to Funding turn times through Efficiency & Automation

Commercial Credit Servicing Platform part of the early Commercial Product Delivery

Digital Credit Memos & Dynamic Checklists

Automated Workflow Routing with Que Management

Closing Docs automated in Workflow with Docusign Integration

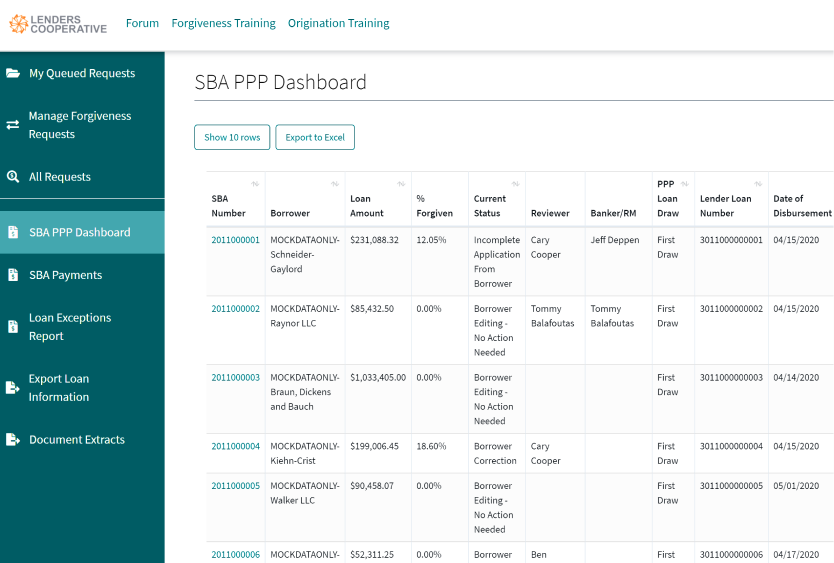

Real Time Dashboard Reporting

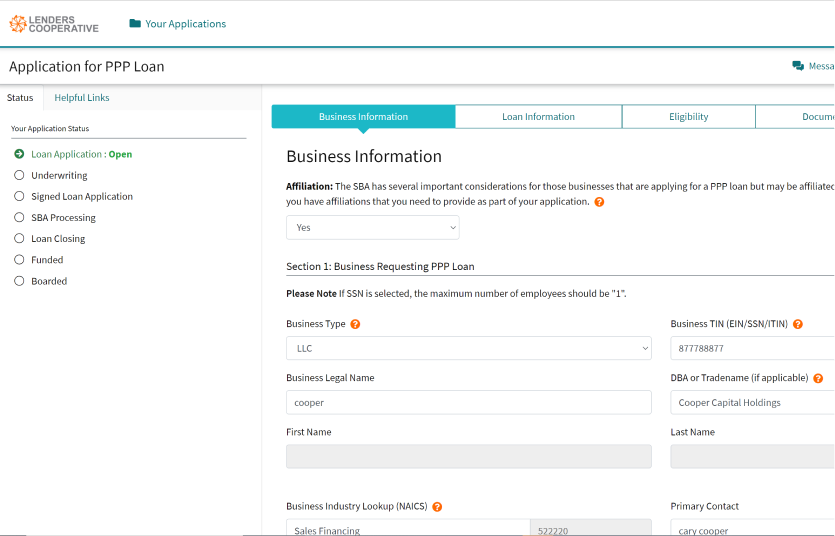

Simple Digital Application & Documentation Intake can be launched by Borrower or Lender

Automated Borrower Notifications provides Real Time Status Updates

Digital Intake leads to Efficiencies in Underwriting & Fulfillment / Funding

24/7 Application Intake Capability allows Business Owner access at their convenience

Trusted By

Associated with