STG: Splunk Managed Service/Capabilities

Information Security

100+ Apps and Use cases

-

Data Sources and apps – examples include

-

Network (Syslog/Cisco FTD/ASA/Palo Alto/Meraki).

-

Third party Software (Rapid7/Duo MFA/Meraki/Proofpoint).

-

Event logs (Windows/Linux/DB events).

-

Change control (Configurations/File changes/Audit logs).

-

Ransomware defense (File or system level changes/Monitor user logins).

-

Customized Info-Sec app for Single pane of glass view of your Security posture and deep dive on security events.

-

1000+ custom knowledge objects (Dashboards/Alerts/Reports) based on prior Splunk implementation for Community banks.

-

Effective FDIC and Security Audits with all relevant information residing on Splunk (Data lake).

Business Analytics

5+ Core Banking Applications

-

JackHenry Silverlake integration

-

Proprietary data pipeline and app to connect JH Silverlake DB running on DB2 (AS400) with PCI DSS compliant Splunk.

-

Custom data models/dashboards/Reports (25+) to drive business intelligence from Core data.

-

Other banking cores (Fiserv/FIS) are also supported.

-

ATM Ops, security and Financial crime prevention app

-

ATM logging (Diebold/NCR).

-

Custom app to monitor PIN change, withdrawals, deposit operations.

-

Online and Mobile banking

-

Custom app for tracking online/mobile transactions.

-

Internet banking security app.

Operations Analytics

100+ Apps and Use cases

-

Data Sources and apps – examples include.

-

Windows Infra (AD/Domain Controller/Servers)

-

VMWare Infra (Hypervisor/Vcenter/ESXI/VM)

-

Office 365

-

AWS

-

ServiceNow

-

STG Infrastructure app – Consolidated view of your entire operations in a single dashboard.

-

1000+ custom knowledge objects (Dashboards/Alerts/Reports) customized for operations analytics for Community banks.

Business Analytics

3+ Custom Apps

-

Compliance app

-

Custom apps for LoS (Calyx), nCino and Salesforce data ingestion and visualization on Splunk.

-

HMDA and CRA reporting using Splunk.

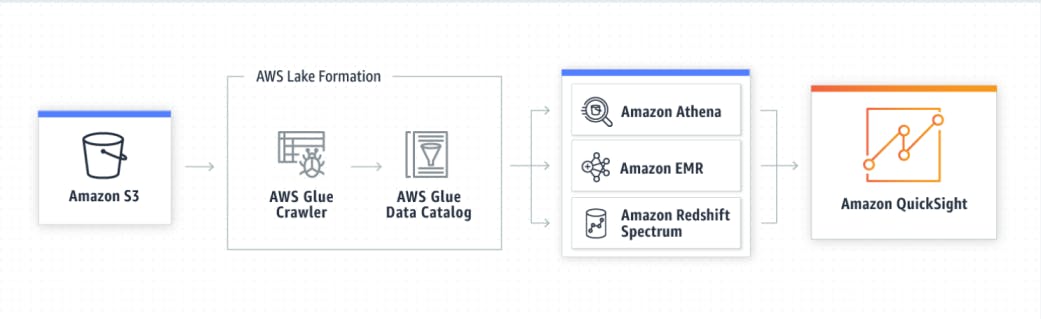

Amazon QuickSight is an Amazon Web Service (AWS) service built for the cloud that enables customers to visualize their data. Quicksight is used for creating and publishing dashboards that include machine learning (ML) powered insights which can be accessed from any device.

STG utilizes Quicksights across our internal products and services - and have developed a public offering for community banks that sits atop their Core Banking data and allows insights and visualizations.